To get an idea of how complementary currencies work and how useful they are in a local environment, we propose an approach to the following complementary currencies:

Let’s study in more detail some cases of complementary currencies.

Case study: MARICÁ, mumbuca digital currency[xiii]

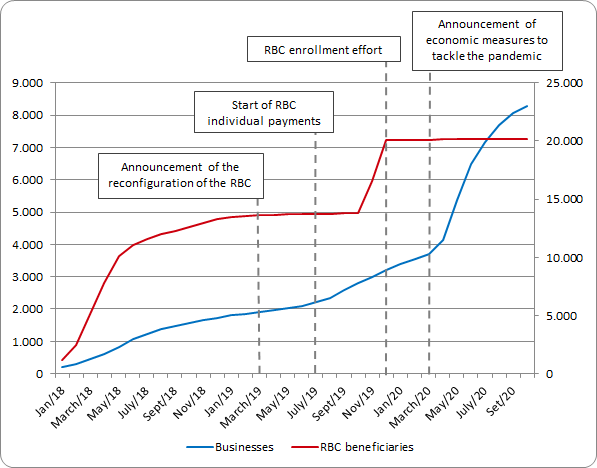

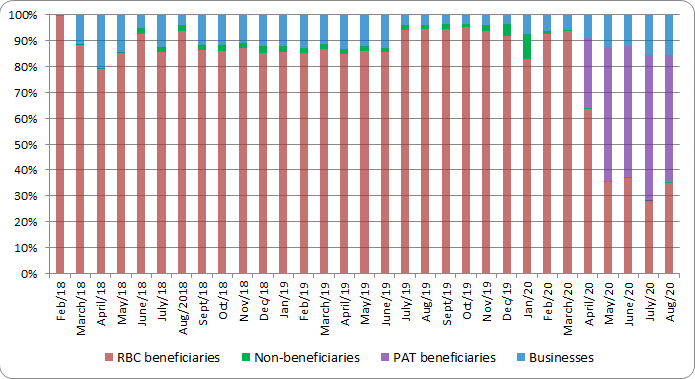

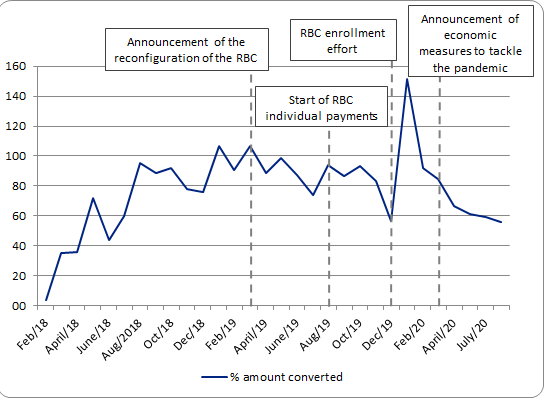

Mumbuca Bank is a municipal community bank, different from other community banks which are not community owned. Gama explains that [xiv] the “Mumbuca Bank issues the mumbuca, which has a one-to-one equivalence with Brazil’s official currency, the real (plural reais). Most of the issuing of mumbucas comes from the payment of welfare benefits. Between 2018 and 2020, the Citizens’ Basic Income program (RBC, Renda Básica de Cidadania in Portuguese) and the Worker Support Program (PAT, Programa de Amparo ao Trabalhador in Portuguese) were the two main cash transfer programs paid in mumbuca. The Mayor’s Office deposits the amount of the benefit in the Mumbuca Bank and provides the bank with the list of beneficiaries, and the bank transfers each payment”.

In 2018, the mumbuca joined the E-dinheiro platform[xv] of the Brazilian Network of Community Banks. Many of those banks are not public and the leading ones is Banco Palmas which is a well-known SSE initiative. This allowed any resident of Maricá was able to open an account at the Mumbuca Bank and effect transactions in mumbucas. This also facilitated that a growing number of companies adopt this system and promoted the use of the currency since it reduced the time for the companies to receive the money in their accounts. Also small individual entrepreneurs – formal and informal can use it. In addition, a few companies and institutions, such as the Mumbuca Bank itself, have adopted the mumbuca to pay monthly salaries.

The sustainability of the bank is also reinforced through the charging of minor fees to both businesses and account holders.

- Policies: The main policies involved in this case are SSE and Social Policies (mainly cash-transfer in welfare benefits) but also finance and tax policies, since Marica obtains sizable funds from OIL (through the collection of royalties and taxes) but, contrary to other governments, they have used them to foster social policies and among them they created a sovereign wealth fund (achieved over 55 million dollars). The Program seeks to stimulate the city’s development through local production and tackle poverty and inequality through income cash transfers. The same law created the Mumbuca Bank and the mumbuca, a local and digital currency which can be used only within the city.

Source: Gama, Andrea & Costa, Roberta. (2021)

Businesses have two inducements for registering at the Mumbuca Bank. First, the adoption of the E-dinheiro platform in 2018 simplified the registration process at the bank. Second, with the creation of the RBC, the benefit becomes individual, increasing the amount of mumbucas in circulation.

The COVID-19 measures not only increased the amount of RBC benefits, but also introduced 20,627 PAT beneficiaries into the Maricá economy, which increased the volume of mumbucas in circulation and, consequently, consumption in mumbucas.

Source: Gama, Andrea & Costa, Roberta. (2021)

As of 2018, the currency acquired a greater capacity to circulate in the city’s economy. Small businesses can use the revenue they receive in mumbuca to consume and buy input and materials in other Maricá establishments, expanding the currency cycle. As more individuals have access to mumbucas and more businesses accept it, there is a higher circulation level of the local currency within Maricá.

- SSE dimension: despite the Bank being a municipal (public) institution, its model is based on SSE models and principles. Besides, it also supports SSE economic units, including informal ones. Finally, the E-dinheiro platform, which is key in the development of this policy belongs to the Network of SSE banks of Brazil and it was bought by Banco Palmas on behalf of this network.

- Co-production: both the policy and the community bank (as well as the currency) were co-designed with and advocated by local citizens and SSE initiatives.

Case study: La Grama (Santa Coloma de Gramenet)

Santa Coloma de Gramenet has issued a social currency it calls the Grama, with the object of incentivising local trade and strengthening residents’ commitment to their town.

Some years ago, the Santa Coloma Town Council realised that many local businesses were putting up the shutters, customers were leaving to shop in department stores in the neighbouring cities and there was a high risk that Santa Coloma would become a dormitory town. The wealth being generated in the town was leaking away and there was a liquidity crisis. According to one study, 90% of the money paid out by the local authority had left within three days.

For a town without much industry or tourism, trade is the motor of wealth[xvi].

The Grama is the first municipal local currency in Catalunya, and it began circulating in January 2017, with a parity of 1 Grama = 1 Euro.

The main objectives are:

- Increase the impact of public spending (subsidies, salaries, purchases from suppliers) in local businesses and increase the circulation of money between businesses in Santa Coloma.

- Behind the initiative was the wish to incentivise local business and strengthen residents’ commitment to their town. ‘I’m from Santa Coloma. I shop in Santa Coloma’ is the campaign included in this overall objective.

The Local Currency is a Digital Payment System (by Internet and mainly with the mobile phone). They are transfers of balance from one user’s account to another user’s account (such as credit card payments). One Grama can be changed for one euro after 45 days, but if it’s changed before that, a penalisation of 5% is incurred.

This is one of the few local currencies that have been co-produced with an active participation of a local administration. In the case of la Grama, the City Council of Santa Coloma de Gramenet was the leader of the project, with the active participation of organizations who were part of the Social Trade Circuit.

The system functions as follows (City Council Website):

- The City Council gives part of the subsidies, grants and wages in Gramas (through the digital payments system)

- NGOS (receiving grants), workers (receiving salaries) and businesses (public projects) will use the local currency in registered shops and businesses

- Registered shops and businesses will use the local currency at other registered shops, both as businesses and as individuals

- This way, the money circulates more times and for longer within the city, creating wealth

Example:

The City Council pays € 20,000,000 a year in net wages to workers.

If 2% of this expense is paid in Gramas, that would mean a total of € 400,000 in income for local commerce (if the % were larger…).

If the Gramas circulate 2 times more than the Euro, that’s € 800,000 for local commerce… There are projects where the Local Currency circulates up to 6 times more than the Euro.

For the awarding of subsidies, the City Council has defined the following criteria:

- The sale of ecological, local, fair trade products and services.

- The purchase in Santa Coloma de Gramenet of products and services for the development of the activity of the company or entity.

- Cooperativism and the provision of products or services of cooperatives and/or entities of the social and solidarity economy.

- Be associated with local or social entities and financial support to local or social entities.

- The supply of green (renewable) energy, low consumption, recycling, reuse and actions to reduce the impact on the environment in general.

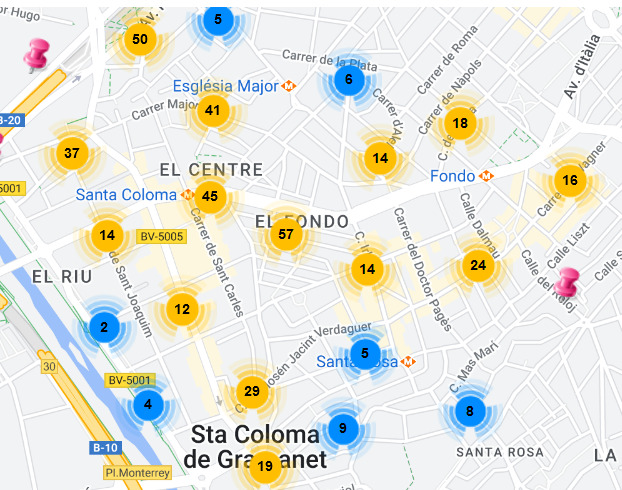

Currently, the city has a social commerce network of 800 members, of which 400 are businesses, cooperatives and companies, 150 are associations and entities, and 250 are individuals. In the last semester of 2019, the number of members of businesses, cooperatives and companies grew by more than 25%.

Case study: Brixton Pound (United Kingdom)

The Brixton Pound is a community currency operating In South London, UK. Although primarily designed to support local SMEs, the Brixton Pound also seeks to increase the sense of community cohesion and draw on the area’s history of social activism. Valued one-to-one against pound sterling, the Brixton Pound can only be spent with local SMEs and thereby aims to retain wealth within the community. Many participating businesses offer discounts to those paying in Brixton Pounds–in effect offering a loyalty scheme that both demonstrates their commitment to the local economy and increases custom. In the long term, increased links between Brixton-based SMEs themselves localise as far as possible supply and production chains to create a more sustainable and resilient economy for the area.

record producer and arranger who was born in Brixton

The Brixton Pound has demonstrated commitment to supporting independent businesses through vocal opposition to plans that would see many well-known local establishments evicted from one of Brixton’s famous high streets: Atlantic Road. The high profile of the Brixton Pound helped the campaign gain media attention and draw 13,000 signatures on a petition protesting the evictions (the campaign was ongoing at the time of writing). This demonstrates how currency initiatives can situate themselves within wider communal, social and political life and the benefits they can bring to an area beyond monetary value.